Understanding how the mining supply chain works can help you navigate delays and costs when importing cars or parts. This guide explains the key steps, challenges, and strategies mining companies use to stay resilient in uncertain times—offering practical tips for budget-conscious buyers who want smoother, more predictable deliveries.

Table of Content:

- What Makes the Mining Supply Chain So Complex?

- How Do External Factors Impact Mining Operations?

- How Did the Pandemic Affect Mining Supply Chains?

- How Resilient Is the Mining Industry in a Crisis?

- Why Is Supply Chain Flexibility More Important Than Ever?

- How Can Companies Cut Costs Without Sacrificing Supply Chain Efficiency?

- What Lessons Can Small Buyers Learn from Mining Supply Chains?

What Makes the Mining Supply Chain So Complex?

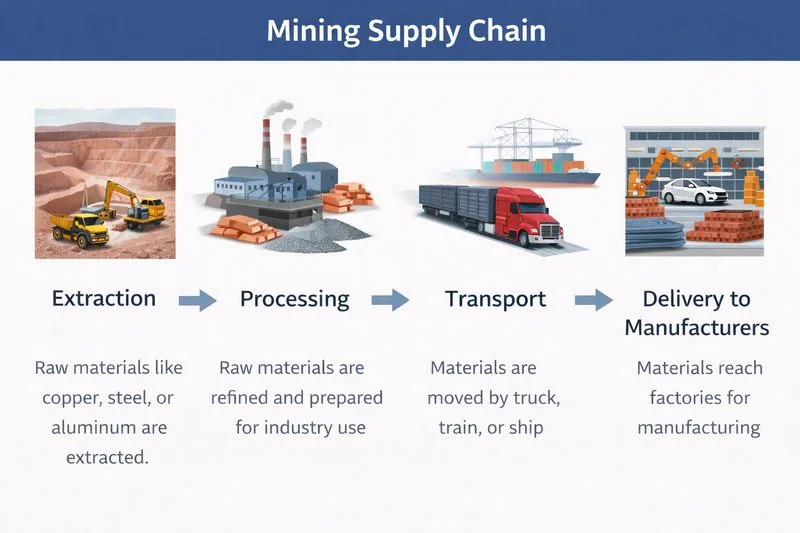

Mining may seem straightforward—dig up minerals and ship them—but in reality, it’s a chain of many interconnected steps. First, raw materials like copper, steel, or aluminum must be extracted from the mine safely and efficiently. Then, these materials go through processing, where they are refined and prepared for use in industries like automotive manufacturing. Next comes transportation, which often involves moving heavy loads by trucks, trains, or ships across long distances. Finally, the materials reach factories or storage facilities for delivery to manufacturers and distributors.

Each of these steps depends on the one before it. If extraction is delayed because of equipment failure, processing cannot start on time. If transport is delayed by a strike, weather, or port congestion, the finished materials sit waiting, causing a ripple effect down the chain.

Because of this complexity, mining companies invest heavily in advanced planning and strategic risk management. They monitor production schedules, track shipments, and develop contingency plans to handle disruptions. Even with all this preparation, the supply chain remains sensitive to unexpected events.

For someone trying to import a budget-friendly car, this matters more than it might seem. Many car parts rely on metals like steel or copper. If a mine slows down, it can delay the availability of these parts, which can push back delivery timelines and increase shipping costs. Even small delays in raw materials can add hundreds of dollars to the total cost of bringing a car to your driveway.

How Do External Factors Impact Mining Operations?

Even the most carefully planned mining operations are not isolated—they are highly sensitive to external factors. Things outside the mine itself can quickly disrupt the entire supply chain, affecting extraction, processing, and delivery of metals.

Economic swings are a big one. When global demand for metals drops, mining companies may slow production or pause operations. On the flip side, sudden spikes in demand can strain resources, causing delays and higher prices. For example, if copper prices surge, it may become more expensive to produce car wiring or brake components, directly impacting the cost of importing vehicles.

Labor shortages are another critical factor. Mines need skilled workers for both extraction and processing. If a strike happens, or workers are unavailable due to illness or travel restrictions, operations can stall. Even a short pause at a single mine can reduce global supply, since some mines contribute a large percentage of certain metals.

Natural disasters and weather can also play havoc with mining supply chains. Heavy rains, floods, or earthquakes can block roads, damage equipment, or close ports. When this happens, trucks and ships carrying metals are delayed, slowing down production lines that rely on them.

For instance, imagine a copper mine shuts down unexpectedly due to flooding. Manufacturers that use copper in car parts—like electrical wiring or brake lines—suddenly have less material to work with. This shortage can lead to higher prices for those parts and, ultimately, higher delivery costs or longer wait times for buyers importing cars on a budget.

How Did the Pandemic Affect Mining Supply Chains?

The COVID-19 pandemic exposed just how vulnerable even well-planned mining supply chains can be. Mines rely on a steady workforce, smooth transportation, and constant operations to keep materials moving. When the pandemic hit, all of these elements faced serious disruptions.

Many mines had to temporarily close due to government lockdowns or outbreaks among workers. For example, during the early months of the pandemic, a large number of copper mines in South America shut down to prevent the spread of the virus. Even short closures created noticeable gaps in global supply because these mines contribute a significant portion of the world’s copper production.

Transport disruptions added another layer of complexity. Trucking, shipping, and rail networks slowed down as restrictions were enforced at borders or ports. This meant that even when mines could operate, getting metals to processing facilities or factories took longer than usual.

The result was a ripple effect across industries. Reduced production led to higher material costs for metals like copper and steel. Factories producing car parts had fewer materials available, which slowed manufacturing and increased the final cost of components.

For budget-conscious car buyers, these disruptions were felt in practical ways. A small delay at a mine could translate into longer shipping times for imported vehicles or higher delivery costs. Even affordable cars could take weeks longer to arrive, and the overall price might creep up as suppliers passed along the extra costs.

How Resilient Is the Mining Industry in a Crisis?

While the pandemic and other unexpected events have caused disruptions, the mining industry has shown surprising resilience. Experts note that it can withstand temporary shocks much longer than many people assume. For example, studies suggest that it would take more than six months of strict lockdowns to seriously affect global mining output. That’s because mines are carefully managed, with contingency plans, backup equipment, and flexible labor strategies in place to keep operations running as smoothly as possible.

However, the real challenge today isn’t just keeping the machinery running or workers on site—it’s market demand and changing customer behavior. During crises, customers may buy less, shift preferences, or delay orders, creating uncertainty for mining companies. For instance, if automakers slow production because consumers are hesitant to buy new cars, mines producing steel or copper might need to adjust output to avoid oversupply.

For budget-conscious car buyers, this shift can have direct effects. Even if mines continue operating efficiently, fluctuating demand can influence pricing and availability. A popular car model may take longer to arrive or cost more simply because fewer parts are being produced or shipped.

Why Is Supply Chain Flexibility More Important Than Ever?

In today’s unpredictable world, mining companies can no longer rely on fixed schedules or rigid processes. Flexibility and agility have become essential for keeping supply chains running smoothly. Mines must be ready to adjust production, redirect shipments, or change priorities at a moment’s notice when unexpected events occur—whether it’s a sudden labor shortage, a spike in demand, or transportation delays.

Being flexible isn’t just about reacting; it’s also about planning for multiple scenarios. Companies that can quickly switch suppliers, reroute shipments, or adjust output levels are much better equipped to handle uncertainty. Those that remain rigid risk costly delays, wasted materials, and missed opportunities in the market.

This is where partnering with reliable transport and logistics providers like YK Freight makes a real difference. Logistics experts can help mining companies—and by extension, industries that depend on metals—navigate disruptions efficiently. YK Freight tracks shipments, identifies alternative routes, and ensures deliveries reach their destinations on time, even when parts of the supply chain face delays.

For budget-conscious car buyers, this flexibility matters more than it might seem. Even if your car relies on materials like steel or copper from mines halfway around the world, a strong logistics partner can reduce delays and unexpected costs. That means your vehicle is more likely to arrive on schedule, and the overall delivery expense stays closer to your budget.

How Can Companies Cut Costs Without Sacrificing Supply Chain Efficiency?

Running a mining supply chain is expensive, but companies don’t have to compromise efficiency to save money. There are practical strategies that help reduce costs while keeping operations smooth.

One approach is careful route planning. By mapping the fastest and most reliable transport routes, companies can avoid delays caused by traffic, road closures, or port congestion. This not only saves time but also reduces fuel and labor costs.

Another strategy is prioritizing critical shipments. Mines and manufacturers focus on sending the most important materials first—like metals needed for high-demand products—while less urgent shipments can follow later. This ensures that production lines keep running without unnecessary stockpiles or wasted resources.

Outsourcing logistics to reliable partners like YK Freight is another key cost-saving measure. Instead of handling every shipment in-house, mining companies can rely on experienced logistics providers to manage transport, track deliveries, and navigate potential disruptions. This reduces mistakes, prevents delays, and often costs less than maintaining large internal fleets.

For budget-conscious car buyers, these strategies have a real impact. Efficient mining and delivery operations mean that the metals and parts used in your car arrive on time and at lower cost. That translates into faster delivery times and smaller shipping fees for buyers, even when importing vehicles from overseas.

What Lessons Can Small Buyers Learn from Mining Supply Chains?

Even if you’re just importing a car or shipping parts for personal use, there are valuable lessons to learn from how the mining industry manages its supply chains. Mining companies face complex risks—like labor shortages, transport delays, and market fluctuations—and they handle these challenges with careful planning, flexibility, and strong partnerships. The same principles can apply to your own shipping decisions.

Planning ahead is key. Just like a mine schedules extraction, processing, and transport to avoid bottlenecks, you should prepare for shipping by checking delivery times, required documentation, and potential customs delays. Planning helps prevent last-minute surprises that can cost time and money.

Flexibility matters too. Mines often adjust their routes, suppliers, or schedules in response to unexpected disruptions. As a buyer, you can also stay flexible—choosing alternative shipping dates, routes, or delivery methods if problems arise—to avoid costly delays.

Finally, working with dependable partners is essential. Mining companies rely on trusted logistics providers like YK Freight to ensure materials move smoothly, even in uncertain times. For small buyers, partnering with a reliable shipping service means your car or parts are more likely to arrive on time, without unexpected fees or stress.

Further Reading

Building a Resilient Supply Chain: Strategies for Reliable, Cost-Friendly Delivery

How to Optimize Your Oil and Gas Supply Chain for Cost and Efficiency

How Supply Chain Management Works: A Guide for Small Businesses

Reducing Logistics Costs: Tips from YK Freight Experts

ASK YOUR QUESTIONS